If you're interested in a career in banking consulting, you're certainly not alone. Many bank executives have worked for decades, so they are well-versed in how to navigate the political environment and keep their clients happy. The best bank consultants are not only long-time politicians with extensive industry knowledge; they have also made huge sacrifices to help their clients.

Qualifications to become bank consultant

A bank consultant's job involves providing advice and information to customers regarding financial products and services. Customers can also use them to apply for loans and manage their accounts. Consultants usually work under the direction of a senior colleague. Consultants work a 9-to-5 standard schedule, and they do not work weekends or evenings.

Bank consultants need to have excellent communication skills as well as sound financial knowledge. A bank consultant must be able to analyze well and be motivated. A good understanding of computers is essential. This job requires you to travel. It is rewarding, and it comes with attractive benefits. You can learn more about the requirements and qualifications for this career by reading on.

A consultant works in a diverse team and will have the chance to work with senior executives. They will also receive unmatched exposure. They will become part of a team, and can make a significant impact on the bank's operations. Consultants work in small groups to solve problems and find solutions. They may also participate in implementation.

Job description

A banking consultant is a person who helps banks with various tasks, such as preparing documents or helping customers apply for loans. They must be able communicate effectively and have a solid understanding of financial information. They must also have problem-solving abilities. These skills are highly sought after as they help banks adapt to changing technologies.

A banking consultant helps financial institutions manage risk, improve services, and develop new products. They help clients make informed decisions regarding their banking relationships. These professionals often have a background that is in finance or Economics. They may also hold certifications from organizations such as FINRA or IARBC. They typically work during regular business hours and do not work on weekends.

An ideal job description for a banking consultant will focus on highlighting the essential skills and qualifications necessary for the position. You should include information about the company's culture, values, career path, and professional development opportunities.

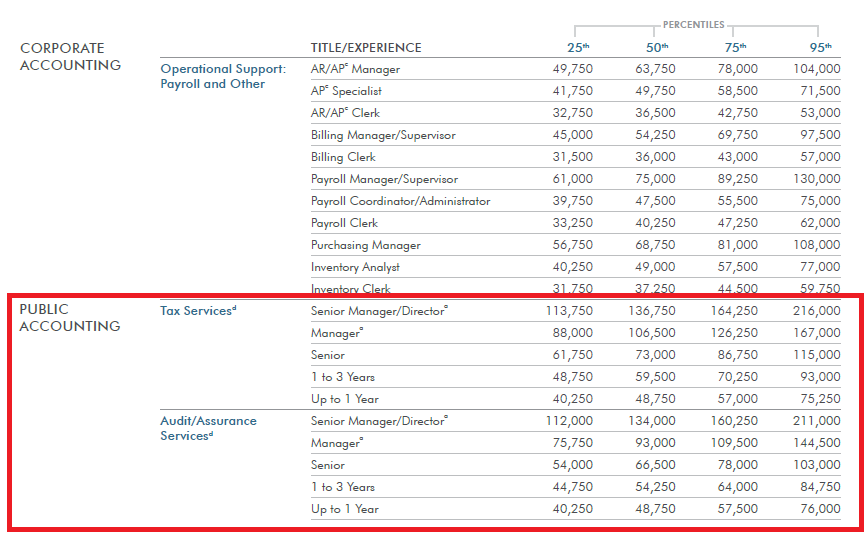

Salary

In the United States, salaries for banking consultant positions vary greatly. ZipRecruiter reports that this occupation has an average annual salary of $73,900 to $188,000. However, the highest-paying locations may offer a higher salary than the national mean. Saint Helena's median annual salary is $84,673, which nearly $15,000 less than the national standard. However, the average salary for this position is likely to differ depending on the industry and experience of the candidate.

While leaving a full-time job is not an easy decision, the high-paying role of a consultant may be worth it if you can secure a senior position. Senior consultants often make a similar salary to full-time employees, in addition to having the independence and benefits. Organizations often turn to consultants and interim professionals for filling in the gaps caused by employee turnover. They evaluate potential full-time employees and lead strategic financial initiatives.

FAQ

How long does it usually take to become an expert consultant?

The amount of time needed depends on your industry and background. People start work with a few weeks before they find employment.

However, consultants can spend many years learning before they are able to find work.

What jobs are available as consultants?

Being a consultant will require you to have a solid understanding of business strategy as well as operations. Understanding the business world and how it fits into society is essential.

You must have excellent communication skills as well as the ability to think critically in order to be a consultant.

Because they might be required to complete different tasks at different times, consultants must be flexible. They should be able change direction quickly, if required.

They should be willing to travel extensively on behalf of their clients. They may be required to travel all over the globe for this type of work.

They need to be able and able to manage pressure and stress. Sometimes, consultants may be required to meet strict deadlines.

As a consultant, you may be expected to work long hours. This means that you may not always get paid overtime rates.

What happens after the consultant has finished the job?

After the consultant finishes the work, s/he will send a final report outlining the results. This report details the project timeline, deliverables, as well any other pertinent information.

After that, you'll go through the report and decide if it meets your expectations. If not, you can either request changes or terminate the contract.

What is the difference?

An advisor provides information about a topic. A consultant can offer solutions.

To help clients achieve their goals, a consultant works directly with them. A consultant provides advice to clients through books and magazines, lectures, seminars, and other means.

Why would a company hire a consultant?

A consultant offers expert advice on improving your business performance. They aren't there to sell your products.

A consultant assists companies in making better decisions by offering sound analysis as well as suggestions for improvement.

Consultants often work with senior management to help them understand how to succeed.

They offer coaching and leadership training to help employees achieve their highest potential.

They may advise businesses on reducing costs, streamlining processes, and increasing efficiency.

How do I start an LLC consultancy business?

First, determine what you are looking to do as service provider. The next step is to ensure that you're qualified for the services you offer. You might find someone who does the same thing you are interested in and learn from them.

Once you've identified the product or service you wish to offer, it is time to determine your target market. If there aren't enough of them, you may need to create them.

Next, you will need to decide if you want to start your own business or hire others.

It is possible to also start your own consulting firm by obtaining a license from the State. But this will require a lot more paperwork and legal costs.

Statistics

- So, if you help your clients increase their sales by 33%, then use a word like “revolution” instead of “increase.” (consultingsuccess.com)

- According to IBISWorld, revenues in the consulting industry will exceed $261 billion in 2020. (nerdwallet.com)

- On average, your program increases the sales team's performance by 33%. (consultingsuccess.com)

- According to statistics from the ONS, the UK has around 300,000 consultants, of which around 63,000 professionals work as management consultants. (consultancy.uk)

- Over 50% of consultants get their first consulting client through a referral from their network. (consultingsuccess.com)

External Links

How To

How do you find the best consultant?

When searching for a consultant, the first thing you should do is ask yourself what your expectations are. Before you begin looking for a consultant, it is important to know what your expectations are. You should make a list of all the things you need from a consultant. This could include: professional expertise and technical skills, project management capabilities, communication skills, availability, etc. You might also want to talk with colleagues or friends about their recommendations. Ask them what their experience with consultants was like and how they compare to yours. You can also do some online research if you don't know of any. You will find many websites such as LinkedIn, Facebook Angie's List, Indeed and Indeed where people can leave reviews about their past work experiences. Take a look at comments and ratings from others, and use that data to find potential candidates. Once you have narrowed down your list, reach out to potential candidates and set up an interview. During the interview, you should talk through your requirements and ask them to explain how they can help you achieve those goals. It doesn’t matter who recommended them to you, just make sure they understand what you are trying to achieve and how they can help.